Business of Startups

- yesterday's slides: http://j.mp/slides-ntu

- yesterday's code: http://j.mp/code-ntu (day1 directory)

- My Story

- Startup Lifecycle

- Startup Economics

- Startup Trends

- Further Reading

My Story

2006

- http://paulgraham.com/mit.html

- http://paulgraham.com/startupmistakes.html

PG's tips for startups

- People over product

- Iteration over perfection

- Great execution over great idea

- "Build something people want"

- Scratch your own itch

- Launch fast/fail fast

Y Combinator

- 8 startups in Summer 2005 to 84 startups in Summer 2012

- http://yclist.com/

- Dropbox, AirBnb: $10 billion

- 17 acquisitions for over $10 million

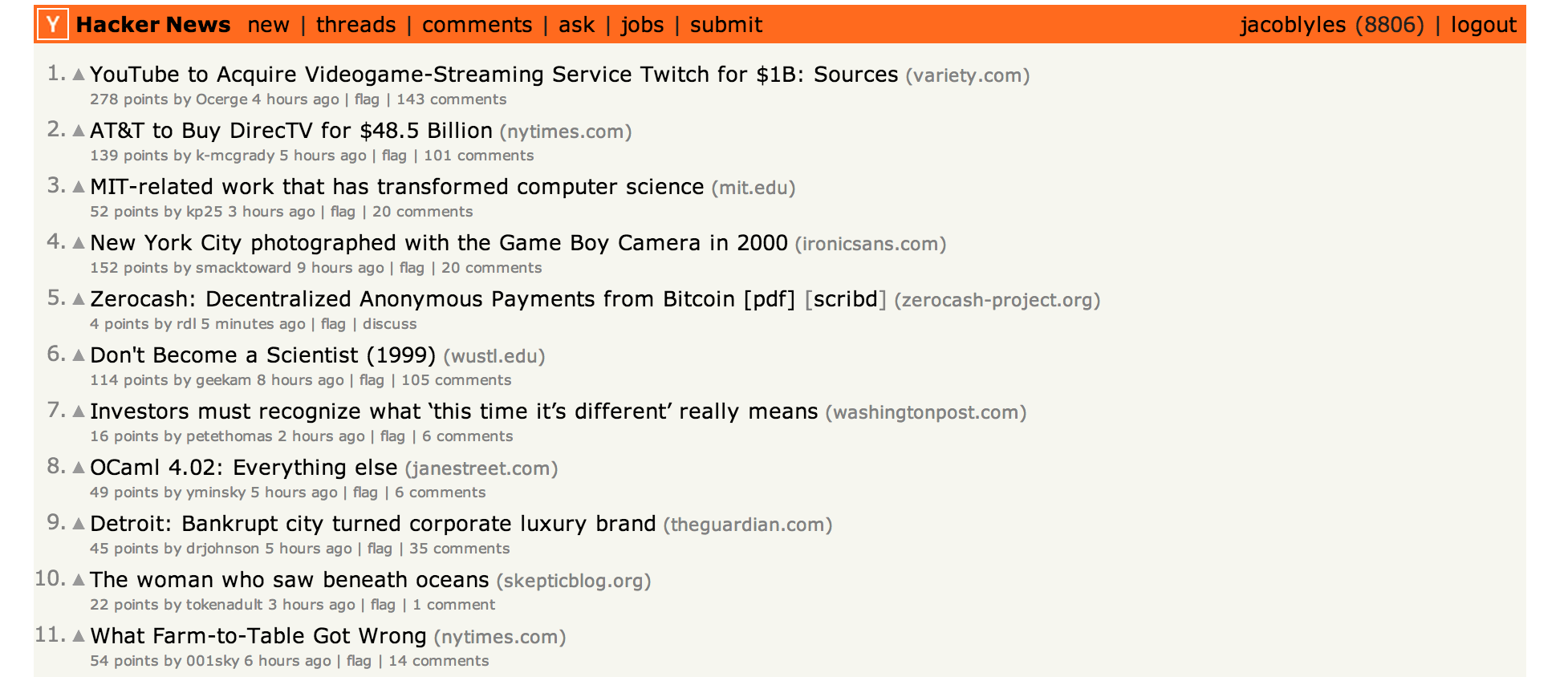

http://news.ycombinator.com

http://startupschool.org/

Noteleaf

Start X

Demo Day

VC

Employee #30 at Coursera, founded by Dahpne Koller and Andrew Ng (Raffles grad)

Game Closure's Start X class

- 13 companies

- 4 acquisitions

- 3 series A rounds

Startup Life Cycle

Pre-existence Stage

- Bootstrapping: running on savings or day-job

- Boostrapped business: 37 Signals "bootstrapped, profitable, and proud"

Early stage

- Get incorporated, divide equity

- Incubator, accelerator

- YC standard: $120k for 7% equity ($1.7M)

- Challenge: gather evidence for business model (100 users)

Funded stage

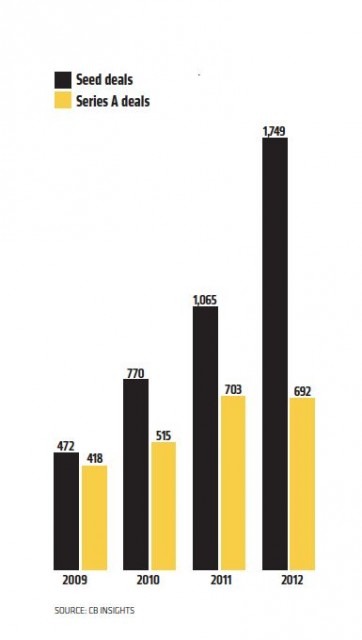

- Seed round: $50,000 - $2 million

- Friends & family + angel investors

- Angel list

- Kickstarter: Oculus Rift, Soylent, Pebble

- Challenge: initial traction (10,000 users)

Middle Stage

- Series A: $2 million - $20 million

- Series B: $10 million - $60 million

- About 20% of seed funded startups get series A

- Each round takes ~20% of equity

- Risk reduces each round: about half at this stage fail

- Challenge: scale traction (1,000,000 users)

Profit Stage

- Don't need more money to stay alive

- May raise money anyway to grow and lock in competitive advantage (Github's $100M)

- Challenge: own the market

Exit

- Acquihire: Posterous -> Twitter (~$7 million)

- Acquisition: Heroku -> Salesforce.com ($250 million)

- IPO: Google (raised $1.67 billion at $23 billion valuation)

- Never, stay private: 37 signals

- Die... ~80% startups

Startup Economics

A great tech company

- Creates lots of value

- Lasts a long time

- Captures some of the value it creates

Peter Thiel

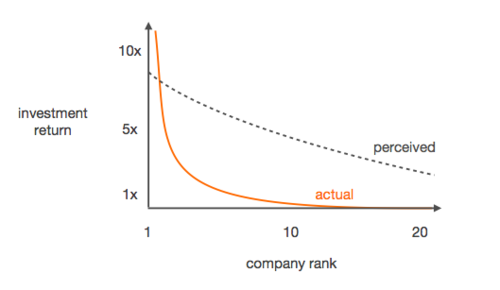

Power law

- YC: top 2 companies (from over 500) = ~90% of YC returns

- Peter Thiel: top 1 company worth as much as rest of Founders Fund 2005

- VC Challenge: Don't miss the big hits!

http://blakemasters.com/post/21869934240/peter-thiels-cs183-startup-class-7-notes-essay

http://blakemasters.com/post/21869934240/peter-thiels-cs183-startup-class-7-notes-essay

Marc Andreesen

- 4,000 companies look for VC funding every year

- 400 get funded by top-tier VC

- 15 account for 90% of returns

- Okay to invest in lots of losers for one 1,000x winner

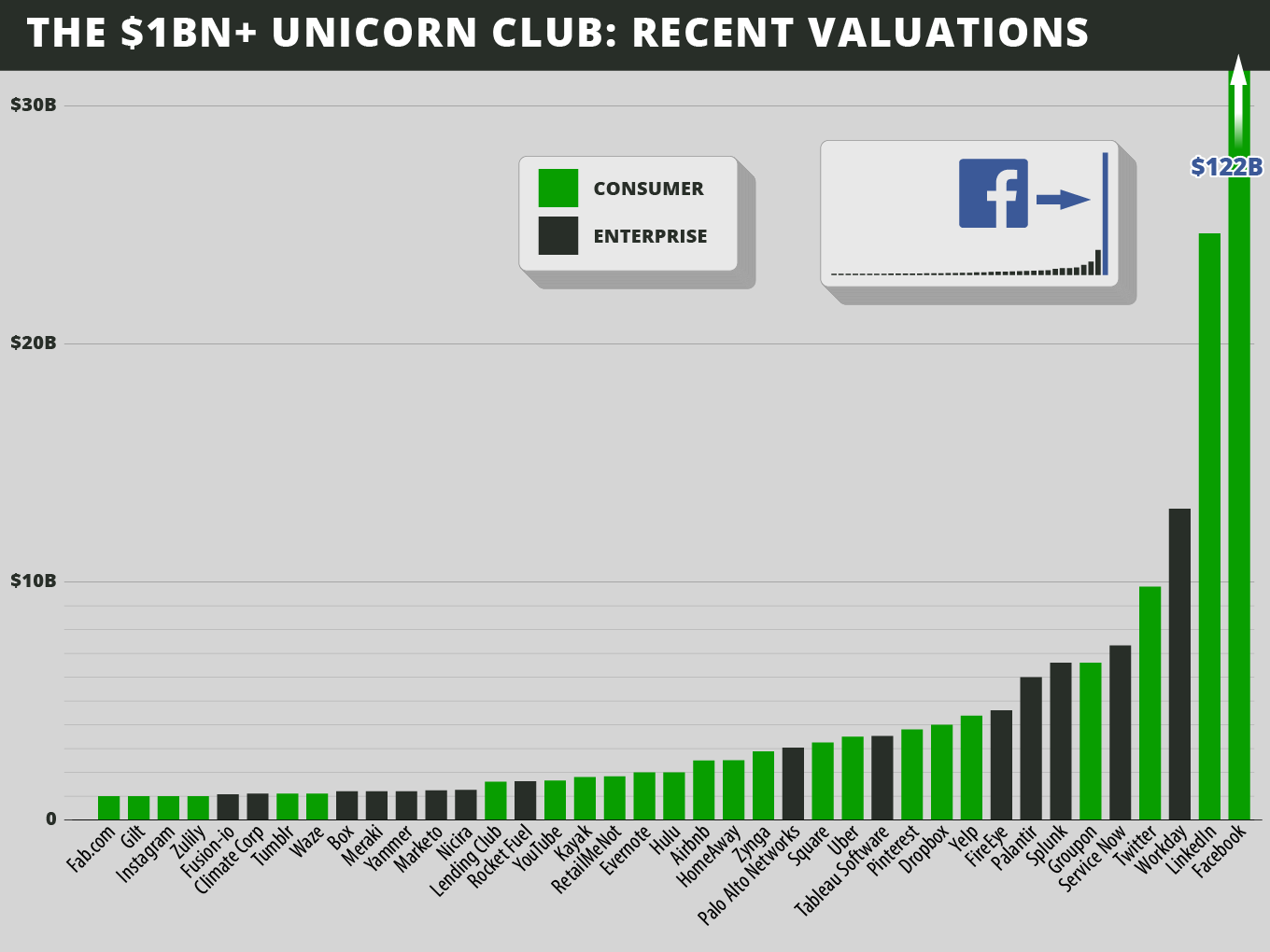

The "Unicorn Club"

- 39 billion-dollar US tech companies in the last 10 years

- http://techcrunch.com/2013/11/02/welcome-to-the-unicorn-club/

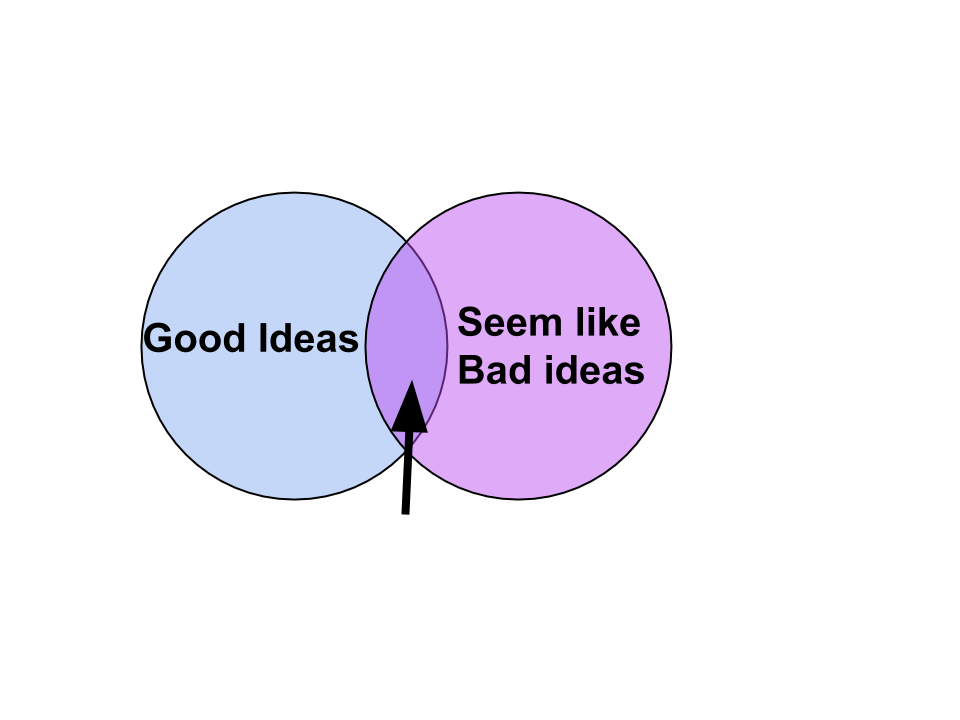

Peter Thiel's startup sweet spot

"what important truth do very few people agree with you on?"

http://blakemasters.com/peter-thiels-cs183-startup

Own your market

- Avoid competitive markets - ex. Restaurants

- Valuable startups have a competitive advantage

- brand (clothing, colas)

- scale cost advantages (Amazon.com)

- network effects (twitter)

- or proprietary technology (Paypal fraud detection)

Total Addressable Market

- Who cares if you own a market if it is tiny...

- example: US Advertising $144B/year

Customer Acquisition

- CLV = customer lifetime value

- ARPU = avg. revenue per user per month

- r = retention rate (per month)

- ACL = average customer lifetime = 1 / (1 - r)

- CPA = cost per acquisition

CLV = ARPU * ACL * gross margin

if CLV > CPA, then spend!

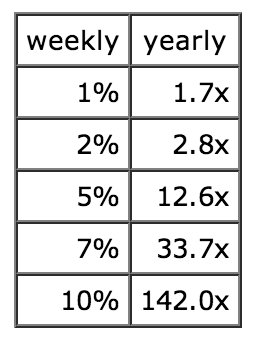

Exponential Growth

- "rule of 72" - doubling period is 72 / growth rate

- doubling adds up quick!

http://www.paulgraham.com/growth.html

Virality

- K-factor: how many new users does a new user bring in

- K-factor over 1 for true viral growth

- Viral cycle: how fast does it happen

- see: http://www.forentrepreneurs.com/lessons-learnt-viral-marketing/

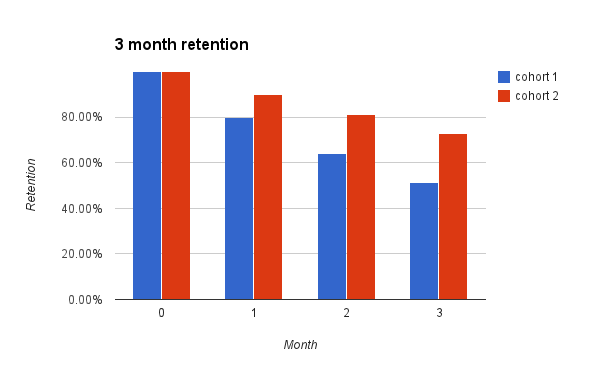

Retention

- Change in 90-day retention reflect the health of the business

- Other health metrics: Monthly Active Users, Daily Active Users, DAU / MAU

Stock Options

- Typically, founders keep 80% of equity and award 20% to employees

- Typical 1st employee: 1.0%. 20th employees: 0.1%

- Working at a startup vs. founding - better salary, less risk, less equity

- But to be Facebook millionaire, only needed 0.001% of company

- Most grants vest over four years

Startup trends

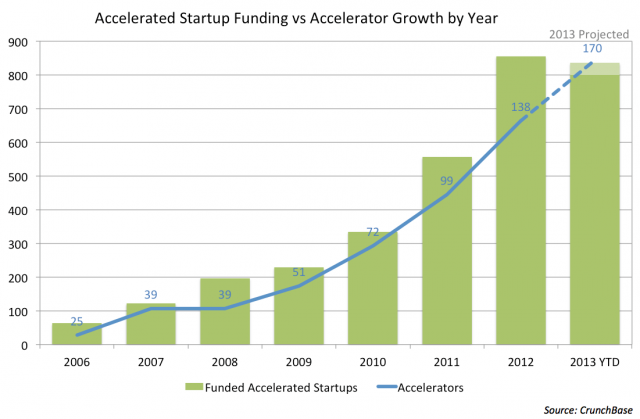

Early stage funding growth

http://techcrunch.com/2013/11/19/the-startup-accelerator-trend-is-finally-slowing-down/

http://techcrunch.com/2013/11/19/the-startup-accelerator-trend-is-finally-slowing-down/

Series A crunch

http://tech.co/series-crunch-demystified-2013-12

Software is eating the world

- Phrase coined by Marc Andreesen

- Software startups taking over non-software industries: Uber(taxis), Homejoy(home cleaning), Amazon(book stores)

- Previously: music, entertainment, telephony, retail, advertising, classified ads, encyclopedias, maps

- Possible future: entire financial industry (bitcoin), education (coursera), health (distance medicine), contract law (ethereum), travel (Occulus), taxi/trucking/railway (self-driving cars)

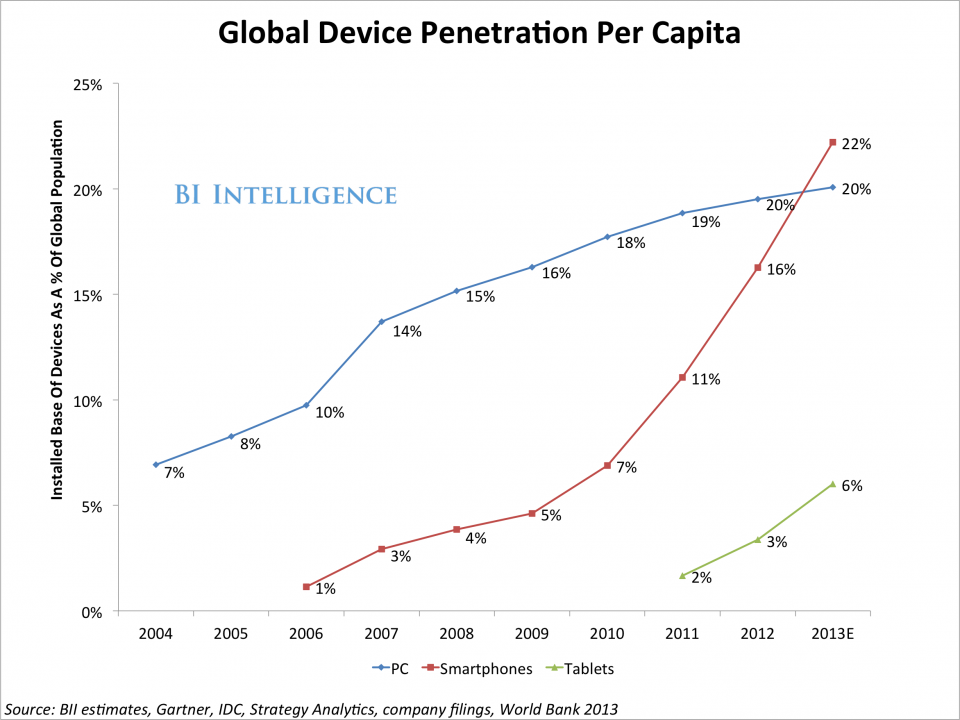

Mobile is eating the startup world

http://www.businessinsider.com/smartphone-and-tablet-penetration-2013-10

http://www.businessinsider.com/smartphone-and-tablet-penetration-2013-10

Breakthrough technologies

- "Sci Fi" tech

- Bitcoin, Artificial Intelligence, drones/robotics, 3D printing, VR, applied genetics, living forever...

- Calico, Google X, Elon Musk, YC request for breakthrough startups: http://blog.samaltman.com/new-rfs-breakthrough-technologies

Hardware is back

- Due to crowd funding platforms (kickstarter, indiegogo) and easy to use prototyping hardware (arduino)

- ex. Occulus, Pebble, Soylent

Internationalization of startups

- YC taking startup school global

- 22 companies in last batch

Books about founders:

- Founders at Work

- In the Plex

- Steve Jobs

- The Hard Thing about Hard Things

- Zero to One (or the Thiel lecture notes: http://blakemasters.com/peter-thiels-cs183-startup)

- Hackers and Painters

- The Tinkerings of Robert Noyce